- Name of the county in which the fine was imposed or assessed,

- General type of charge (traffic, simple/criminal, or civil infraction), and

- Case or citation number. If you do not know this number you may search using your name.

After you submit this information, the system will search for matching cases. Follow instructions to make your payment.

- Restitution for victims of crime.

- Fines, penalties, criminal penalty surcharge, and law enforcement initiative surcharge.

- Crime Victim Compensation Fund.

- Court costs, including correctional fees, court-appointed attorney fees, and public defender expenses.

All court debts are paid in the priority order listed above. Pay court debt to the clerk of court in the county where the violation occurred. The Clerk of Court offices are listed on the Court Directory page.

Be alert for potential scams, including spam emails falsely claiming to be from the Iowa Judicial Branch or a court official. The Iowa Judicial Branch will never send an email that asks you to send money, give a social security number, direct you to call a certain phone number, or advise you to download a document from within the email.

- If a county attorney has entered into an agreement with State Court Administration and has committed to collecting court debt, then the debt will be assigned to the county attorney when the debt is delinquent.

- If the offense occurred in a county where the county attorney has not committed to collecting, then the debt will be assigned to the Central Collections Unit of the Iowa Department of Revenue to collect debt owed to the State of Iowa when the debt is delinquent.

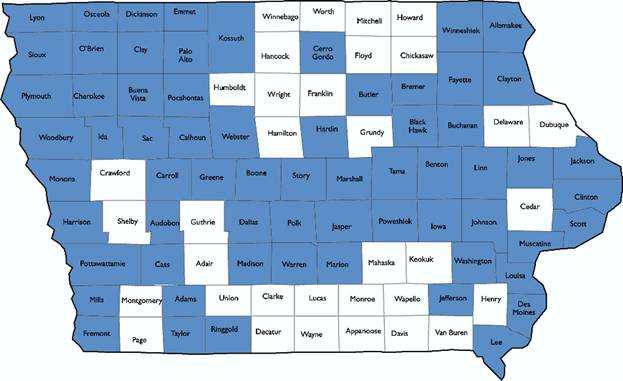

On the map, dark counties indicate county attorneys collect court debt, light counties indicate Central Collections Unit collects court debt.

Counties where the county attorney collects court debt more than 30 days past due.

- Adams

- Allamakee

- Audubon

- Benton

- Black

- Boone

- Bremer

- Buchanan

- Buena Vista

- Butler

- Calhoun

- Carroll

- Cass

- Cerro Gordo

- Cherokee

- Clay

- Clayton

- Clinton

- Dallas

- Des Moines

- Dickinson

- Emmet

- Fayette

- Freemont

- Greene

- Hardin

- Harrison

- Ida

- Iowa

- Jackson

- Jasper

- Jefferson

- Johnson

- Jones

- Kossuth

- Lee

- Linn

- Louisa

- Lyon

- Madison

- Marion

- Marshall

- Mills

- Monona

- Muscatine

- O'Brien

- Osceola

- Palo Alto

- Plymouth

- Pocahontas

- Polk

- Pottawattamie

- Poweshiek

- Ringgold

- Sac

- Scott

- Sioux

- Story

- Tama

- Taylor

- Warren

- Washington

- Webster

- Winneshiek

- Woodbury

- Any county attorney collecting court debt can collect any debt related to a violation of state traffic laws or laws of the road.

- A county attorney from one county can enter an agreement to collect court debt for one or more contiguous counties. In this situation a county attorney other than where the violation occurred may collect the court debt.

Except for these two situations, the county attorney where the violation occurred or a third party debt collector designated by the judicial branch must collect the debt.

There are other state and county entities that can withhold owed fees from your state income tax refund.

These answers are intended to be general in nature and may not address specific situations; therefore, if you need more information specific to your situation, please contact your attorney, the clerk in your county, or your county attorney office if your county attorney is collecting court debt in the county where the offense occurred